Foreign VCs dominate in Nigeria As local investors bankroll Egyptian startups,

Nigeria tech ecosystem’s march to the throne of a most attractive destination for investors in Africa is likely to be a reality again in 2021 but its local venture capital (VC) scene would take the second seat once again.

READ ALSO: Visa joins cryptocurrency market, now allows crypto transaction, but not bitcoin

In Egypt, though, this is hardly to be the case as local investments compete equitably in the tech investment activities in terms of volume.

Over the years, tech investment has grown significantly in Egypt. In 2019, for example, the number of funded ventures rose to 159 percent on 2018 figures, data from Disrupt Africa shows.

The number dropped to 82 startups in 2020 on the back of the pandemic, the country was nonetheless second only to Nigeria and also means that the number of funded Egyptian startups has grown by 1,540 percent since 2015 when only five startups secured investment.

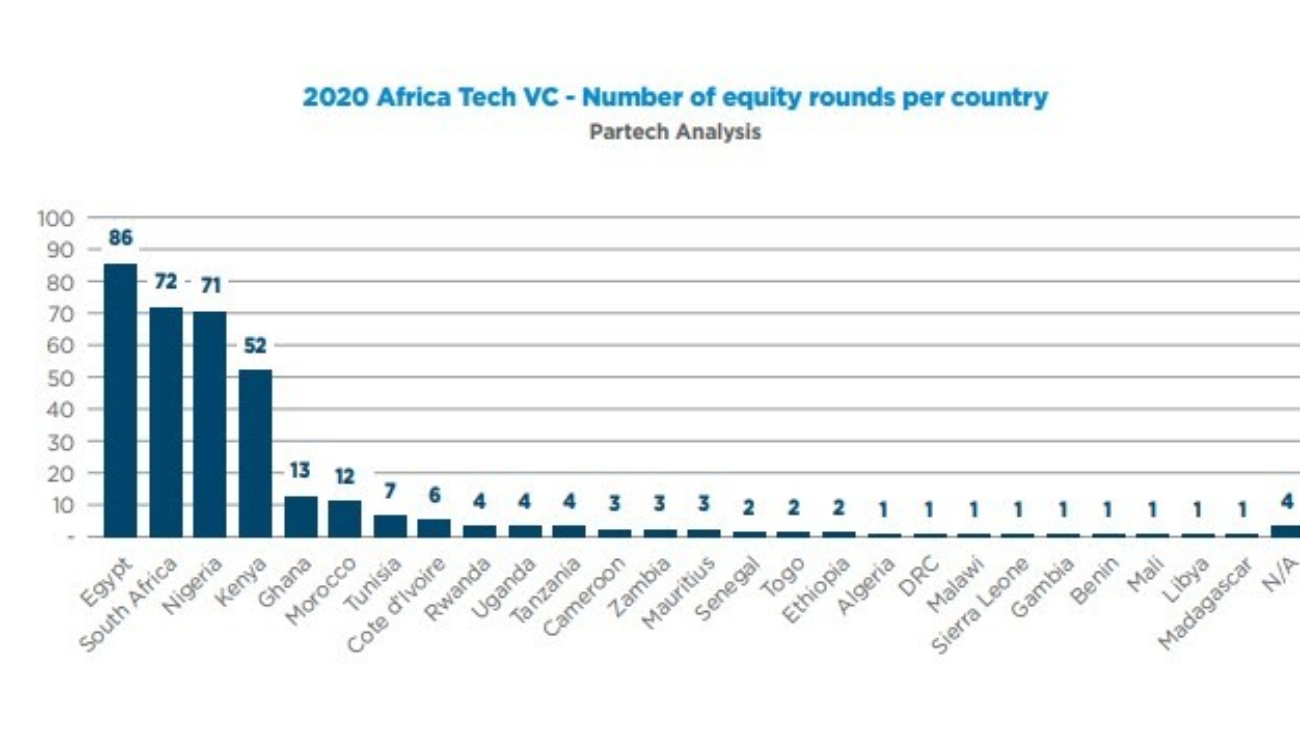

Egypt, actually, ranked number one in Africa in the number of equity deals with 86, representing over 83 percent growth year-on-year and almost a quarter of the continent’s VC transactions in 2020, according to Partech’s report.

In terms of total equity funding, Egypt also sees the highest growth rate out of the top 4 markets with over 28 percent year-on-year growth, attracting $269 million to represent 19 percent of the total funding and maintaining its third place but significantly closing the gap with Nigeria and Kenya.

Egypt owes much of its rise on the continent’s tech ecosystem to a local ecosystem driven by high-quality entrepreneurs and increased activities from local investors plugged into the many regional Middle East and North Africa (MENA) funds.

However, these would not have grown to the level it is without intentional government investment in technology.

The Egyptian government is one of the biggest investors in the tech ecosystem in Egypt. The government does this through its public venture capital programmes. public venture capital organizations are organizations that are funded and controlled by government institutions.

These types of organizations are either completely funded by the government or partially funded by the government.

According to experts, public venture capital organizations usually have a slightly different aim than other VC firms; their main goal is usually focused on promoting the growth of Small and Medium Enterprises (SMEs).

In other cases, their aim is to invest in certain industries or certain areas. When both the government and the private sector contribute to the funds of Public Venture Capital organizations, they are called hybrid funds.

The Central Bank of Egypt in 2019 established a fintech regulatory sandbox as well as the $57 million Fintech Fund.

According to the bank, the funding to be mobilised directly and indirectly by the new platform is expected to start with $50-100 million upon launch reaching $350-500 million over a period of five years.

Apart from the Fintech Fund, the Egyptian government also runs a number of incubation programmes both independently and in collaboration with other organisations.

The government also made a lot of investment in providing technology infrastructure in the country that enables tech businesses and the ecosystem to thrive.