Nigeria’s Department of Petroleum Resources (DPR) has begun notifying successful field bidders in the 2020 marginal fields bidding round, but some are concerned that a forced merger of bidders could spell trouble for the process.

READ ALSO: Bulk of young Nigerians shut out of N75bn youth investment fund

According to people close to the process, the regulator’s decision to merge several bidders has joined people with different operational plans, financial resources, and development plans together on a field and the resulting acrimony could scuttle the process.

“These bidders do not know each other, have different plans and programmes and funding strategies, but have all been forced together in a union of strange bedfellows,” a source close to one of the bidders told BusinessDay, pleading anonymity as he does not have the authority to disclose sensitive matters.

When contacted for clarification, DPR’s spokesman, Paul Osu, did not pick several calls made to him over three days nor did he respond to text messages.

Some analysts also expressed concern that it is likely to lead to conflicts and to slow down the government’s plans to get more out of its hydrocarbon resources.

“It would, to my mind, be forcing people with different plans and strategies to do business together,” said Ayodele Oni, energy lawyer, and partner at Lagos-based Bloomfield Law Firm.

However, people often collaborate in the oil and gas sector to execute projects and considering the inability to develop some marginal fields in the past, the DPR hopes this approach will improve the chances of the fields being developed.

The difference between this forced merger and what commonly obtains in the sector is the absence of consent. Partnerships and collaborations are forged with those pursuing similar outcomes based on agreements on how to share resources as well as profits.

The DPR is compelling people who may have different plans, ideas, and resources, and do not know each other to work on a project.

“I haven’t seen the exact terms of such relationships but I am not sure that’s the best approach in light of the experiences from past Marginal Fields bid rounds, where even partners fell out and successful bidders fell out with their technical partners they had strong arrangements with.

“If those could happen then you can imagine a scenario where companies with different strategies, ethos, and outlooks are forced to do business in common,” Oni said.

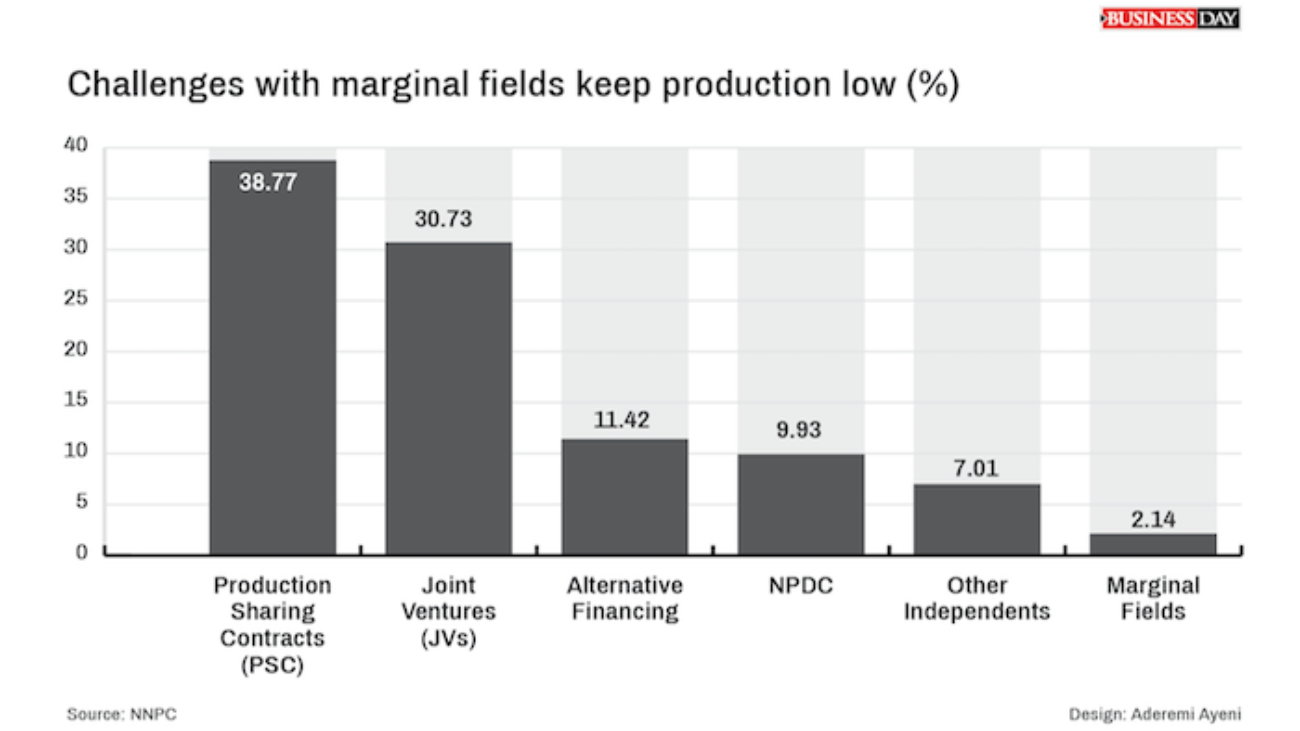

Dozens of fields awarded in different bid rounds have been undeveloped; this is why oil production from these fields accounts for about 2.14 percent of Nigeria’s total production.

According to a report by African Oil Gas Report, a third award letter that specifies the percentage awarded to the recipient and the signature bonus expected of it by the government has been issued.

The letters were emailed on March 2, 2021, and the authorities expect the signature bonus to be paid in 45 days, and it could be paid in either the local currency naira or in dollars, the magazine said in an editorial.

It further said the total signature bonus per field ranges from $5 million to $20 million, but since no single field is assigned to a single company, the signature bonus demanded from each company correlates with the percentage interest in the field offered to the company. If the entire signature bonus charged to Field A is $5 million, a company assigned 20 percent equity in that field is asked to pay a signature bonus of $1 million.

The DPR is seeking to raise $500 million from the signature bonuses to be awarded for 57 marginal oilfields in the bid round processes for the oilfields, which began in June 2020 and would be concluded by the end of the first quarter of 2021.

Sarki Auwalu, the DPR boss, said the objective of the exercise was to deepen the participation of indigenous companies in the upstream segment of the industry and provide opportunities for technical and financial partnerships for investors.

Out of the over 600 companies that applied for pre-qualification, 161 were successful and shortlisted to advance to the next and final stage of the bid round process, Auwalu said.

The department had decided to join different bidders in a single field to raise the prospects that the fields would not be abandoned. Several marginal fields awarded in the past have been abandoned largely due to the financial and technical incompetence of the bidders.

Auwalu said the $500 million would be different from the monies already generated by the agency through the applications and data leasing by applicants.

READ MORE